Before diving into the process on how to buy an investment property, it’s important to understand what property investment actually involves and how it generates wealth.

Property investment means purchasing real estate to earn a return; either through rental yield (income) or capital growth (value increase). Both work together to create a sustainable path toward financial freedom.

Why Property Investment Works in Australia

Australia’s stable economy, population growth, and consistent demand for housing make it an ideal market for long-term investors. A well-chosen property can appreciate in value while generating rental income that supports mortgage repayments and cash flow.

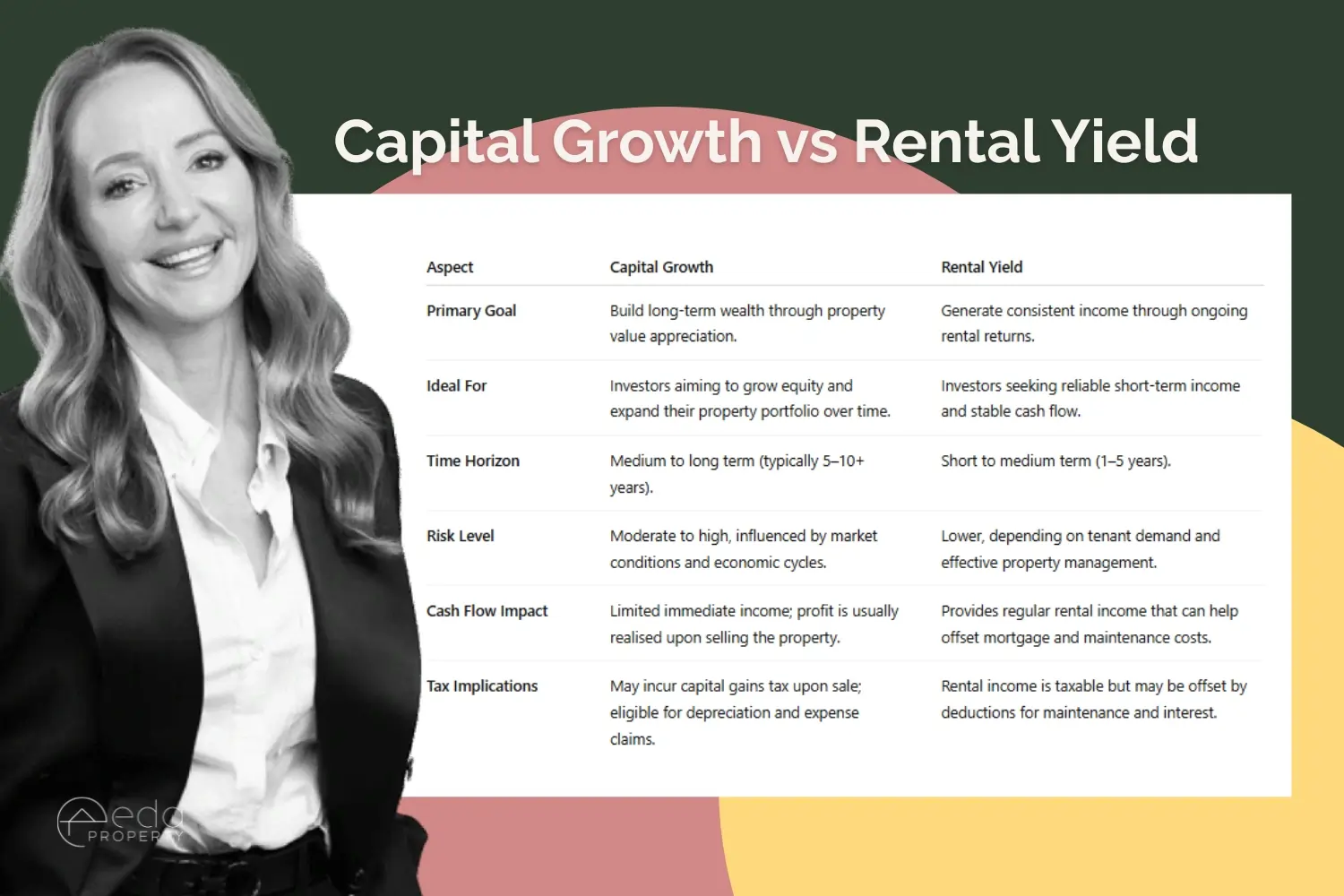

Capital Growth vs Rental Yield

- Capital growth: Increase in a property’s market value over time. Driven by demand, infrastructure, and economic conditions.

- Rental yield: The percentage of annual rental income compared to the purchase price, a good indicator of short-term performance.

Here’s a snapshot comparison

Prelude

A strong portfolio often includes a mix of high-yield and high-growth properties. For example, city apartments may provide reliable rent, while suburban houses tend to deliver higher appreciation over time. However, achieving this balance doesn’t happen by chance, it starts with a structured investment plan.

Understanding how to buy an investment property in Australia step by step helps you identify which opportunities align with your financial goals, whether that’s consistent rental income or long-term capital growth.

Step-by-Step Guide on How to Buy an Investment Property

Step 1: Set Clear Investment Goals

Before you buy, define what success looks like. Are you aiming for financial freedom, passive income, or long-term capital growth? Your goals determine your property type, budget, and location strategy.

For example:

- Income-focused investors might seek established rental properties with strong yields.

- Long-term planners might prioritise developing suburbs or family-oriented communities with growth potential.

Having a clear purpose ensures you make decisions based on evidence, not emotion.

Step 2: Assess Your Financial Position

Before entering the market, evaluate your financial readiness. Check your savings, borrowing power, and credit history. Most lenders in Australia require a 10–20% deposit, plus funds for stamp duty, legal fees, and other costs.

Consulting a mortgage broker or financial adviser helps you:

- Determine borrowing capacity

- Choose between interest-only or principal-and-interest loans

Explore tax-effective structures for ownership

Tip: Get loan pre-approval before you start searching. It gives you clarity and makes you a more competitive buyer.

Step 3: Research the Market

Market research forms the foundation of every successful investment.

Look into:

- Population growth and job demand

- Infrastructure and transport projects

- Median prices, rental yields, and vacancy rates

Reliable data sources include CoreLogic, SQM Research, and ABS reports. Choose areas with consistent performance rather than speculative “hotspots.”

Pro Tip: Suburbs near new schools, hospitals, or transport links often deliver steady growth over time.

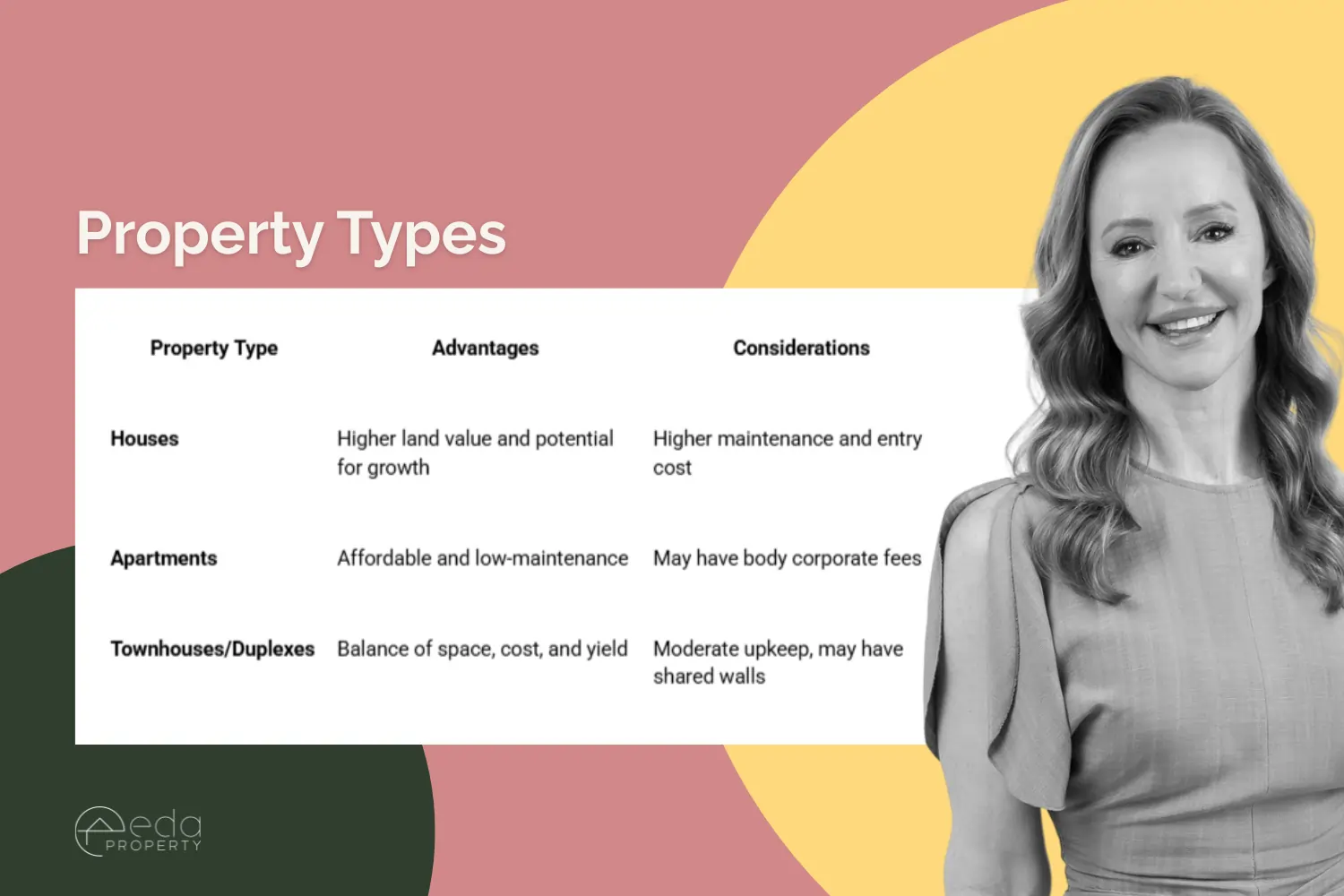

Step 4: Choose the Right Property Type

The best property depends on your strategy, budget, and risk appetite.

New vs Established

- New builds often include tax depreciation benefits and minimal repairs.

- Established homes may offer better long-term capital growth if bought below market value.

Step 5: Secure Finance and Pre-Approval

Once your finances are in order, work with your mortgage broker to finalise your loan structure.

Consider:

- Offset accounts to reduce interest

- Trust ownership for asset protection

- Interest-only periods for flexibility

Pre-approval ensures you can move fast when the right property becomes available.

Step 6: Conduct Due Diligence

Before signing anything, complete thorough checks:

- Building and pest inspection

- Title, zoning, and legal searches

- Rental appraisal and strata reports (if applicable)

This protects you from unforeseen costs or compliance issues later on. Always use a qualified solicitor or conveyancer during this stage.

Step 7: Make an Offer and Finalise the Purchase

When you’re confident in your choice, it’s time to make an offer; either through private treaty, auction, or off-market deal. Use recent comparable sales as your benchmark and negotiate strategically. Once accepted, sign the contract, pay your deposit, and move toward settlement.

Step 8: Plan for Ongoing Management

Property ownership doesn’t stop at purchase. You’ll need a plan for maintenance, tenant management, and compliance.

A professional property manager can handle:

- Tenant sourcing and screening

- Rent collection and maintenance

- Legal compliance with tenancy laws

This ensures your investment runs smoothly while protecting your returns.

Step 9: Review and Grow Your Portfolio

Over time, as your property value increases, you can use equity to fund future investments. Regularly review your portfolio’s performance, including:

- Rental yield

- Capital growth

- Loan-to-value ratio

Refinancing or restructuring loans can free up funds for new purchases, allowing your portfolio to expand sustainably.

Step 10: Partner with a Professional Property Investment Advisor

Not everyone has the time or expertise to research markets, compare data, and manage investments efficiently. That’s where a property investment advisor can make a difference.

They can:

- Identify high-growth suburbs

- Coordinate with brokers, solicitors, and managers

- Develop a long-term wealth plan

- Keep you on track with market changes

Partnering with an advisor saves time and helps you avoid costly mistakes by turning property ownership into a strategic wealth-building journey.

Conclusion

Learning how to buy an investment property in Australia isn’t about taking risks, it’s about following a structured, evidence-based process. From defining your goals and securing finance to researching the market and managing your assets, every step builds towards lasting financial independence.

With patience, planning, and professional guidance, your first investment property can become the foundation of a profitable, diversified portfolio.

Ready to start your property investment journey? Contact our team today for expert property investment advice tailored to your goals.

Frequently Asked Questions

Check out the most frequently asked questions about knowing on how to buy an investment property below:

How much deposit do I need for an investment property?

Most lenders require a 10–20% deposit, though higher deposits can improve your borrowing terms and reduce interest costs. Factor in additional expenses such as stamp duty, legal fees, and insurance.

How to buy an investment property for beginners?

Start by setting clear financial goals, understanding your borrowing power, and researching the market. Work with a mortgage broker and property advisor to create a strategy that fits your timeline and budget.

What is the 7% rule in real estate?

The 7% rule is a quick guide suggesting that an investment property should yield at least 7% annually in rental return to ensure positive cash flow and offset ownership costs.

Can I buy an investment property with low income?

Yes, but you’ll need strong savings, minimal debts, and possibly a guarantor. Speaking with a financial advisor or mortgage broker helps you explore financing options suited to your situation.

How often should I review my investment property?

Conduct annual reviews to check rental performance, equity growth, and maintenance needs. Staying proactive helps maximise returns and identify new opportunities.

Share this story!

Buyer’s Agent vs Property Advisor: Which One Do You Actually Need?

If you have ever found yourself torn between using a buyer’s agent or a property advisor, you are definitely not alone. It is one of the [...]

Buying an Investment Property with Just $50 a Week: A Step-by-Step Guide

Buying an investment property might seem out of reach if you’re starting with a small budget, but with the right strategy, it’s absolutely achievable even with [...]

Real Estate Investor vs Property Investor: What’s the Real Difference?

Many Australians use the terms real estate investor and property investor as if they mean the same thing. Both involve buying real estate and earning returns [...]

Get in touch with our property investment advisors today!

Life changes – your property strategy should too. We review your portfolio yearly and support you every step of the way.

We respect your privacy. View our Privacy Policy.

Get in touch with our property investment advisors today!

Life changes – your property strategy should too. We review your portfolio yearly and support you every step of the way.

We respect your privacy. View our Privacy Policy.