Investing in property is one of the most trusted ways Australians build long-term wealth. Yet, the difference between success and struggle often comes down to strategy and guidance. While many people search for property investment tips online, the most valuable advice doesn’t come from guesswork or generic checklists. It comes from professionals who understand how to turn data, timing, and financial goals into a clear path for sustainable growth.

In this guide, we’ll explore the top property investment tips every investor should know. And explain why working with a qualified property investment advisor can help you make smarter, more confident, and more profitable decisions.

Why Property Investment Tips Matter?

Property investment may seem straightforward: buy a property, rent it out, and watch its value grow. However, the Australian market is far more complex. Economic shifts, changing interest rates, and varying state regulations can all impact performance.

These tips help you navigate the layers, ensuring your decisions are grounded in evidence rather than emotion.

1. Start with a Strategic Property Plan

As an advisor or a property investor you have to create a starting point in a plan. That is why this part of the property investment tips starts with helping you understand your personal goals, whether that’s financial freedom, passive income, or retirement security.

An advisor then develops a tailored plan that includes:

- Clear, measurable objectives

Short and long-term property strategies - Realistic financial modelling

Without a structured plan, many investors end up chasing the market or buying based on emotion. A strategic approach keeps your investment journey focused, balanced, and resilient over time. If you are a new investor, understanding what a property investment is would give a good start to your financial planning.

2. Use Professional Market Research Insights

The property market is driven by data: from population growth and infrastructure development to rental demand and vacancy rates.

Advisors have access to proprietary analytics, CoreLogic reports, and economic forecasts that go beyond what’s publicly available. This insight helps pinpoint suburbs with sustainable growth potential instead of short-term hype.

Tip: A good advisor will explain why a suburb is worth investing in, not just tell you where to buy. This is one of the best property investment tips for property investing.

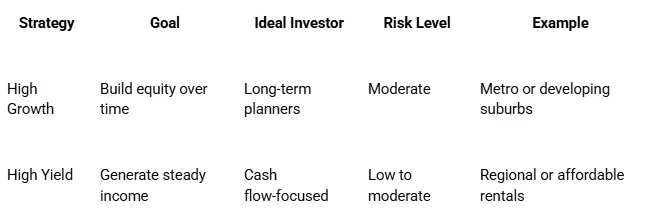

Manage Risk with Portfolio Diversification

An advisor doesn’t just focus on returns; they help you protect your downside. By balancing your portfolio between high-growth and high-yield properties, you can weather market fluctuations more effectively.

High Growth vs High Yield Strategy

This can help ensure your investments align with your tolerance for risk while still supporting your long-term objectives.

3. Understand Complex Property Finance

Property investment isn’t just about location; it’s also about finance. Advisors collaborate with mortgage brokers and accountants to structure loans effectively, whether that’s through offset accounts, interest-only periods, or trust set-ups. This gives you not only good, well-rounded property investment tips but also a good addition to your financial planning when buying a property.

These financial structures can significantly impact your cash flow and tax position. The Australian Securities & Investments Commission (ASIC) – Money Smart provides guidelines on finance and ownership considerations for investors.

4. Avoid Emotional Property Decisions

Buying property is often emotional; location appeal, new builds, or fear of missing out can cloud judgment.

A good investor brings an objective lens, assessing each opportunity using data, comparable sales, and projected returns. This prevents you from overspending or investing in low-performing markets.

5. Know Tax Rules and Stay Compliant

Australia’s property tax system offers several benefits, from depreciation schedules to negative gearing. However, navigating these correctly requires expertise.

You need to ensure your strategy complies with ATO standards while maximising returns through legitimate deductions. Proper tax planning also helps prevent future financial strain and keeps your investment portfolio legally sound.

6. Continue to Learn and Evolve

In the fast-paced world of property investment, being informed is your best weapon. Collaborating with a professional advisor doesn’t diminish your role as an informed investor; it actually boosts it. To maximise this partnership and achieve lasting success, commit yourself to lifelong learning and adaptability.

The market, laws, and investment strategies are always evolving, so staying in the loop is crucial for keeping your approach effective and relevant. Make it a point to read, join seminars, and regularly check your portfolio. Continuous education is one of the most essential property investment tips for 2025. Because those who keep learning are the ones who will continue succeeding.

7. The Long-Term Benefit of Working with Advisors

The most successful investors rarely go it alone. They build long-term partnerships with professionals who understand how to align property performance with personal financial goals.

A trusted advisor not only helps you enter the market confidently but also ensures your portfolio continues to grow sustainably. Whether you’re expanding, refinancing, or diversifying, their ongoing guidance acts as both a safety net and a catalyst for success. They can also provide you with professional property investment advice that is backed by years of experience and actual data.

Conclusion: Smarter Investing Starts with Experts

Property investment isn’t about luck; it’s about strategy, discipline, and insight. By following structured planning and partnering with a qualified advisor, you gain clarity, reduce risk, and unlock opportunities that align with your long-term goals. They can also provide you with professional property investment tips to guide you on your journey in property investing.

Investing with expert guidance turns property from a passive asset into an active wealth-building strategy. Choose one that grows with you, not against you. Need an expert? Contact Eda Property today and start your financial growth journey.

Frequently Asked Questions

Check out the most frequently asked questions about property investment tips below:

How can I make $1,000 a month by investing?

Earning $1,000 a month from investments depends on your chosen asset type, capital, and strategy. In property, this typically comes from positive rental cash flow, where your rental income exceeds expenses like mortgage repayments, maintenance, and insurance. To achieve this, investors often focus on high-yield properties in areas with strong tenant demand. Diversifying your portfolio and working with a property investment advisor can also help identify opportunities that deliver consistent, reliable income.

Can you live off passive income alone?

Yes, it’s possible to live off passive income, but it requires planning, discipline, and a well-built portfolio. For property investors, this means owning multiple income-producing properties with minimal debt, strong rental yields, and long-term tenant stability. A diversified mix of assets, such as real estate, dividends, and managed funds, can further balance cash flow. Partnering with an advisor ensures your portfolio generates sustainable income without overexposure to risk.

What is the best investment in Australia?

There isn’t a single “best” investment. It depends on your financial goals, time horizon, and risk tolerance. However, property investment remains one of Australia’s most reliable wealth-building strategies due to consistent housing demand and long-term appreciation. Other strong investments include exchange-traded funds (ETFs), superannuation contributions, and dividend-paying shares. The key is to align your investments with your income needs and future objectives, ideally with guidance from a licensed professional.

How can I invest in property?

To invest in property, start by setting clear financial goals and assessing your borrowing power. Research high-growth areas, understand rental yield trends, and create a strategy that balances risk and reward. The process typically includes securing finance pre-approval, conducting due diligence, and working with professionals such as mortgage brokers, solicitors, and property managers. For first-time investors, consulting a property investment advisor helps simplify complex decisions and ensures your investment aligns with your long-term wealth goals.

Share this story!

Buyer’s Agent vs Property Advisor: Which One Do You Actually Need?

If you have ever found yourself torn between using a buyer’s agent or a property advisor, you are definitely not alone. It is one of the [...]

Buying an Investment Property with Just $50 a Week: A Step-by-Step Guide

Buying an investment property might seem out of reach if you’re starting with a small budget, but with the right strategy, it’s absolutely achievable even with [...]

Real Estate Investor vs Property Investor: What’s the Real Difference?

Many Australians use the terms real estate investor and property investor as if they mean the same thing. Both involve buying real estate and earning returns [...]

Get in touch with our property investment advisors today!

Life changes – your property strategy should too. We review your portfolio yearly and support you every step of the way.

We respect your privacy. View our Privacy Policy.

Get in touch with our property investment advisors today!

Life changes – your property strategy should too. We review your portfolio yearly and support you every step of the way.

We respect your privacy. View our Privacy Policy.